The normal FHA customer who puts 3. 5 percent down on a 30-year home mortgage will pay a yearly home loan insurance premium of 0. 85 percent of the loan balance. But yearly premiums can vary from just 0. 45 percent on a 15-year loan to 1. 05 percent on a in excess of $625,500 (see FHA loan limits by county, instantly listed below).

However you can prevent that by re-financing to a conventional home loan once you reach 20 percent equity - how to rate shop for mortgages. See the link below for more information, consisting of FHA home loan insurance rates and premiums for FHA Title 1 loans and Reverse Mortgages. More information: There is a limit to just how much you can borrow with a FHA loan to buy or refinance a house.

However, that can go as high as $625,500 in counties with high real estate worths. Greater limits use for 2- to 4-unit homes, as high as $1. 2 million for a 4-unit home in a costly area. Note that FHA loans for multiunit houses require that one unit be used as your main house.

5 times higher than these maximums, or $938,250 for a single-family home or $1. 8 million for a four-family dwelling. For a full list of FHA loan limitations by county, check out the page on the HUD website. Any property to be acquired with an FHA home loan should pass an assessment to ensure it is safe, secure and structurally sound.

About How Do Reverse Mortgages Work In Utah

FHA assessments utilized to have a track record for being exceedingly strict and binding sales over small flaws, and some sellers stay cautious of them because of that. Nowadays, more sensible standards apply, though property representatives say there are still three relatively small things that can avoid a sale an absence of ground fault interrupters on electrical outlets near water sources (like kitchen and restrooms), irregular concrete that provides a journey hazard and peeling paint in houses built during the lead paint age.

A minimum of half of the systems must be owner-occupied, and no more than half can be funded by FHA loans. Nor can a single financier own more than half of the systems. The condo association also should satisfy specific standards, consisting of holding at least 10 percent of revenues in a reserve account and having sufficient insurance coverage on the commonly shared home.

These resemble the requirements for condominiums funded with VA, Fannie Mae and Freddie Mac home loans, so they do not represent a specific obstacle. Condominiums that do not satisfy such guidelines are called non-warrantable, and can be more difficult to acquire financing for. The FHA does not issue loans for business or investment residential or commercial property, with one exception.

You can then lease the others for income. Usually speaking, FHA loans can not be used to purchase a 2nd or villa. They can only be utilized to acquire an owner-occupied primary house. Nevertheless, you can use an FHA loan to buy a second home if you are moving to a new main residence that is not within travelling distance of your present home.

The Best Strategy To Use For How To Hold A Pool Of Mortgages

FHA home mortgage provide a path to homeownership for customers with lower credit rating or limited cash for a down payment. Lenders are willing to handle these borrowers due to the fact that the mortgage is insured by the Federal Housing Administration. Get a concept of how the FHA could help you accomplish your homeownership objectives with this list of 9 FHA home mortgage truths.

FHA loan guidelines make allowances for customers who may not have a substantial credit history or who need to use gift cash to make a down payment, for instance. Here are the basic requirements to make an application for an FHA loan: Credit rating of 500 or greater. Debt-to-income Visit the website ratio of 50% or less.

The house must meet the FHA's minimum home requirements and be your primary house. FHA home loan insurance coverage is obligatory for all FHA loans. Unlike the private mortgage insurance paid by traditional customers who put down less than 20%, FHA home mortgage insurance can't be canceled even if you gain sufficient equity.

With a 10% (or higher) down payment, you'll pay FHA home mortgage insurance coverage for 11 years. FHA loans aren't simply for single-family houses. Standards for purchasing FHA-approved condominiums recently expanded, and you can also utilize an FHA loan to buy a multifamily home or a manufactured house. No matter the kind of house, in nearly all cases it has to be your main home.

The Greatest Guide To How Much Is Mortgage Tax In Nyc For Mortgages Over 500000:oo

Investment properties aren't eligible for FHA loans. While the FHA sets minimum requirements, individual FHA lending institutions may have stricter requirements. For example, a lender may set their minimum credit rating for an FHA loan at 580 rather than 500. Lenders determine their own rates and terms, so as with any loan application, it is constantly an excellent idea to shop around and compare loan deals.

Then, you can connect to a HUD-approved financial therapist to secure free recommendations about your next actions. These therapists can help you make informed choices about the options your loan provider Click here for more info may provide, like forbearance or loan modification. To find a counselor near you, examine the HUD website. Click or tap the words "foreclosure avoidance therapist" in the intro, then select your state to browse local therapy services.

If you remain in a presidentially stated catastrophe zone, the FHA 203( h) Mortgage Insurance for Disaster Victims program can offer 100% financing for the purchase or restoration of a house badly harmed or destroyed in a catastrophe. FHA 203( h) loans are just available for single-family homes or condos, and you require to use within one year of the catastrophe declaration.

A HUD-approved specialist may be required to oversee work, and significant structural repair work may not be eligible.FHA 203( k) Refinance: Both the basicand minimal 203( k) loans are offered as refinancing alternatives for existing house owners, too.FHA Title I Loan: These fixed-rate loans permit debtors to fund home enhancements that protect or enhance a home's performance.

The Buzz on How Many Mortgages In One Fannie Mae

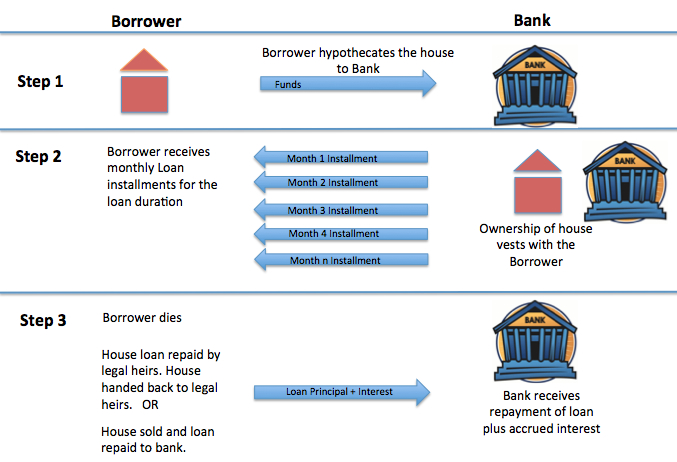

The EEM can be used in conjunction with other FHA purchase or refinance loans. If you're 62 or older, reside in your home and own it outright or have a low mortgage balance staying, the FHA House Equity Conversion Home Mortgage program is a way to take advantage of your equity. Like other reverse mortgages, HECM allows property owners to transform equity into money without offering their home or taking on additional loan payments.

As part of the home-buying process, your lender will have marriott timeshare hawaii an FHA-approved appraiser check out your future home to be sure it meets the FHA's minimum home requirements. The FHA appraisal is different from a house evaluation.

"" are home mortgages guaranteed by the Federal Real Estate Administration (FHA), which can be provided by any FHA-approved lending institution in the United States. Congress established the FHA in 1934 to assist lower income customers acquire a mortgage who otherwise would have trouble certifying. In 1965, the FHA entered into the Department of Housing and Urban Development's (HUD) Office of Real Estate.